Personal loans in the U.S. “have been growing like a weed”, according to Moody’s Analytics chief economist Mark Zandi. The Washington Post and Equifax report that outstanding personal loans balances were up by over 10 percent in the last quarter compared to a year ago, which means that more than 20 million Americans have taken out a personal loan at an average balance of over $16,000 each.

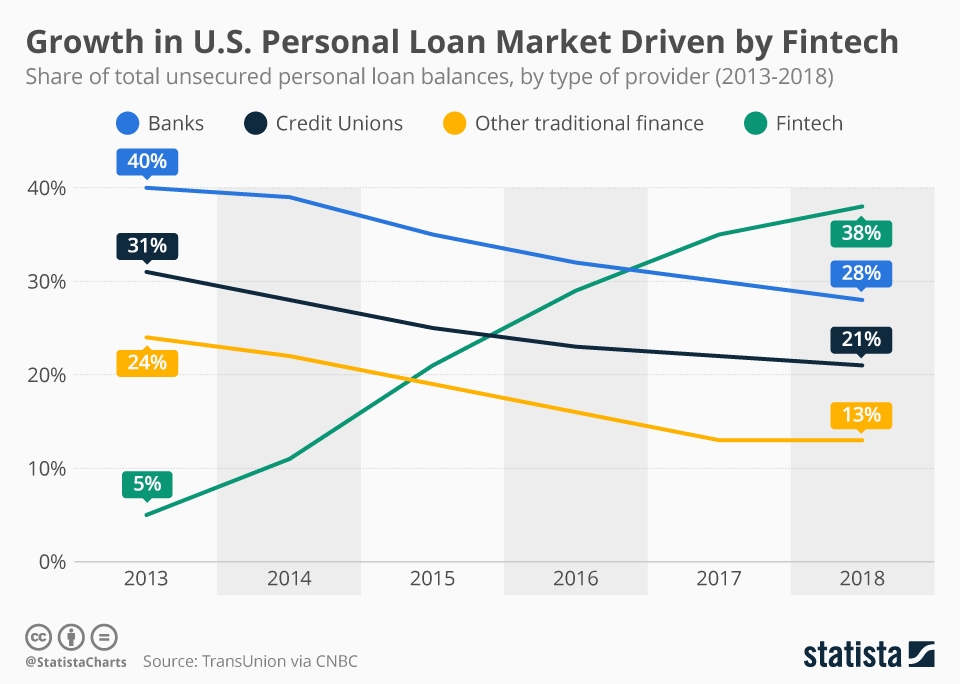

This rapid growth has been tied to the success of fintech lending products, which arrived at a market share of 38 percent of the personal loan market in 2018 and have likely been growing since. As recently as 2013, that share had been 5 percent. Consumers have been turning to apps because many value the easy application process they offer, according to CNBC.

The tendency of Americans to take out more loans does not fit with the fact that jobs and paychecks have been growing in America. Also, the number of subprime borrowers has been overrepresented in the personal loan segment, raising questions to whether customers could pay their rates in the case of an economic downturn. Yet, the personal loan market is smaller compared with credit card and home mortgage debt and a widespread default on loans is not expected to have the same devastating effect the 2008 housing crisis had.