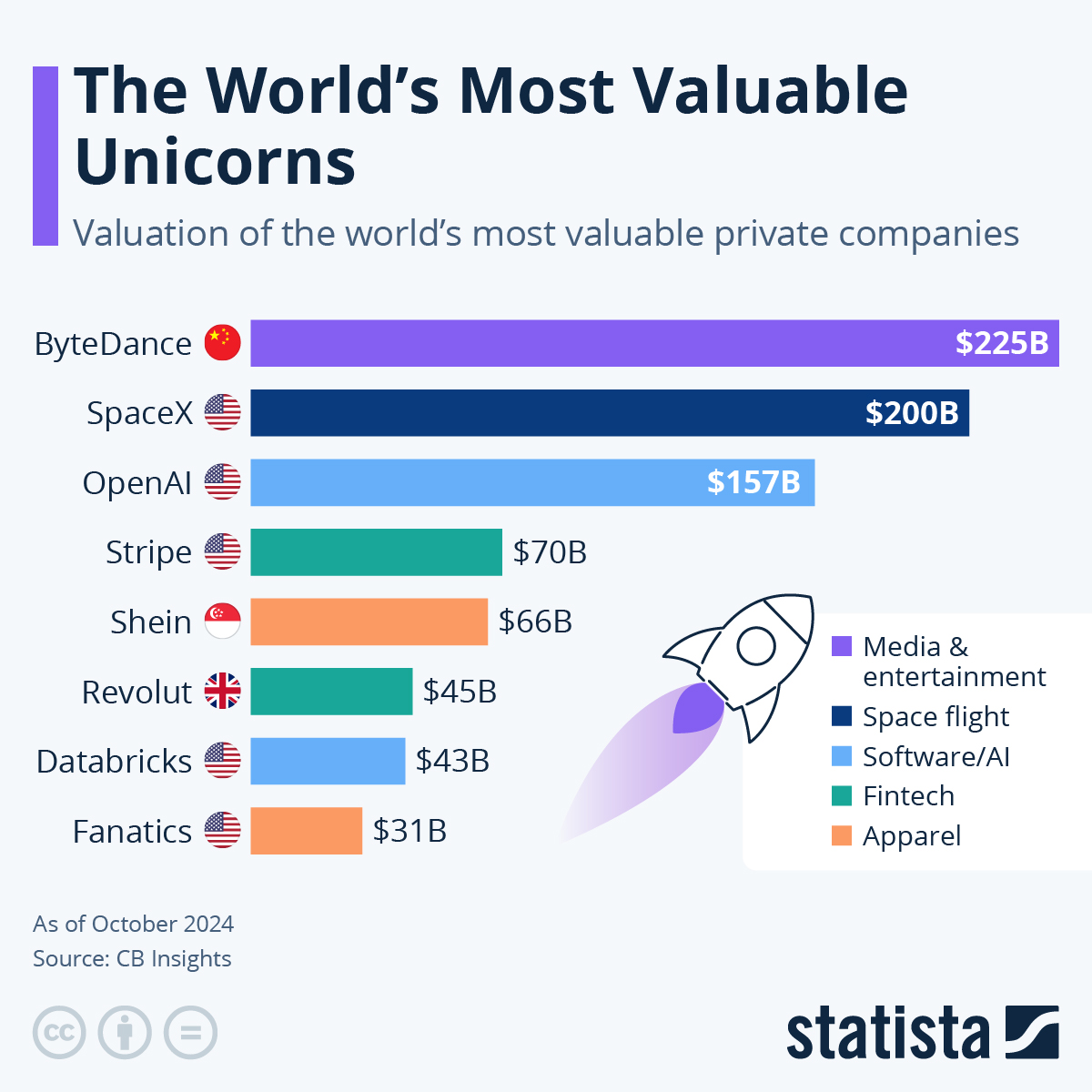

Despite recent jumps in valuation for generative artificial intelligence company OpenAI and Elon Musk's aerospace company SpaceX, ByteDance is still the highest-valued unicorn worldwide. According to CB Insights, the Chinese parent company of TikTok holds a valuation of $225 billion, ahead of SpaceX's $200 billion price tag and OpenAI's latest valuation of $157 billion. Earlier this month, the company behind ChatGPT raised $6.6 billion in fresh funding, almost doubling its previous valuation of $80 billion before the latest funding round.

The remainder of the top list is made up of corporations from the apparel (Shein and Fanatics), fintech (Stripe and Revolut) and software (Databricks) sectors. While OpenAI and Databricks are the only dedicated AI companies, ByteDance has also been focusing on generative artificial intelligence recently. Following suit with Western counterparts like Meta or Alphabet, it launched a suite of large language models under the brand name Doubao in May of this year, according to media reports. This will most likely further cement its standing as the highest-valued unicorn worldwide.

The term unicorn describes companies that are not traded on any stock exchange and at the same time valued at more than $1 billion. CB Insights data suggests that there are currently around 1,200 of these companies worldwide. CrunchBase lists 1,549 such corporations on their ranking, including Alibaba's fintech arm Ant Group and Reliance Retail and Reliance Jio, two subsidiaries of India-based multinational business conglomerate Reliance Industries.

CB Insights' exclusion of these three companies might be connected to their parent corporations being publicly traded, even though no shares for their mentioned subsidiaries are available on stock exchanges. Using the term startup for these companies is also questionable since this terminology is usually reserved for smaller corporations reliant on external funding and not for companies like SpaceX, ByteDance or, more recently, OpenAI.

The latter is not only rapidly moving up the ranks in terms of valuation, but also in terms of revenue. According to comments by CEO Sam Altman in internal meetings reported on by The Information, the company's annualized revenue doubled to $3.4 billion between late 2023 and June 2024.