Less than three months after WeWork, the world’s leading provider of flexible office and coworking space, was forced to issue the dreaded “going concern” warning alongside its latest earnings report, the company has filed for Chapter 11 bankruptcy protection in the United States. On Monday, the company announced that it has begun a "comprehensive reorganization to strengthen its capital structure and financial performance" in order to set it up for future success.

"WeWork has a strong foundation, a dynamic business, and a bright future," the company's CEO David Tolley said in a statement. "Now is the time for us to pull the future forward by aggressively addressing our legacy leases and dramatically improving our balance sheet,” Tolley continued. “We defined a new category of working, and these steps will enable us to remain the global leader in flexible work."

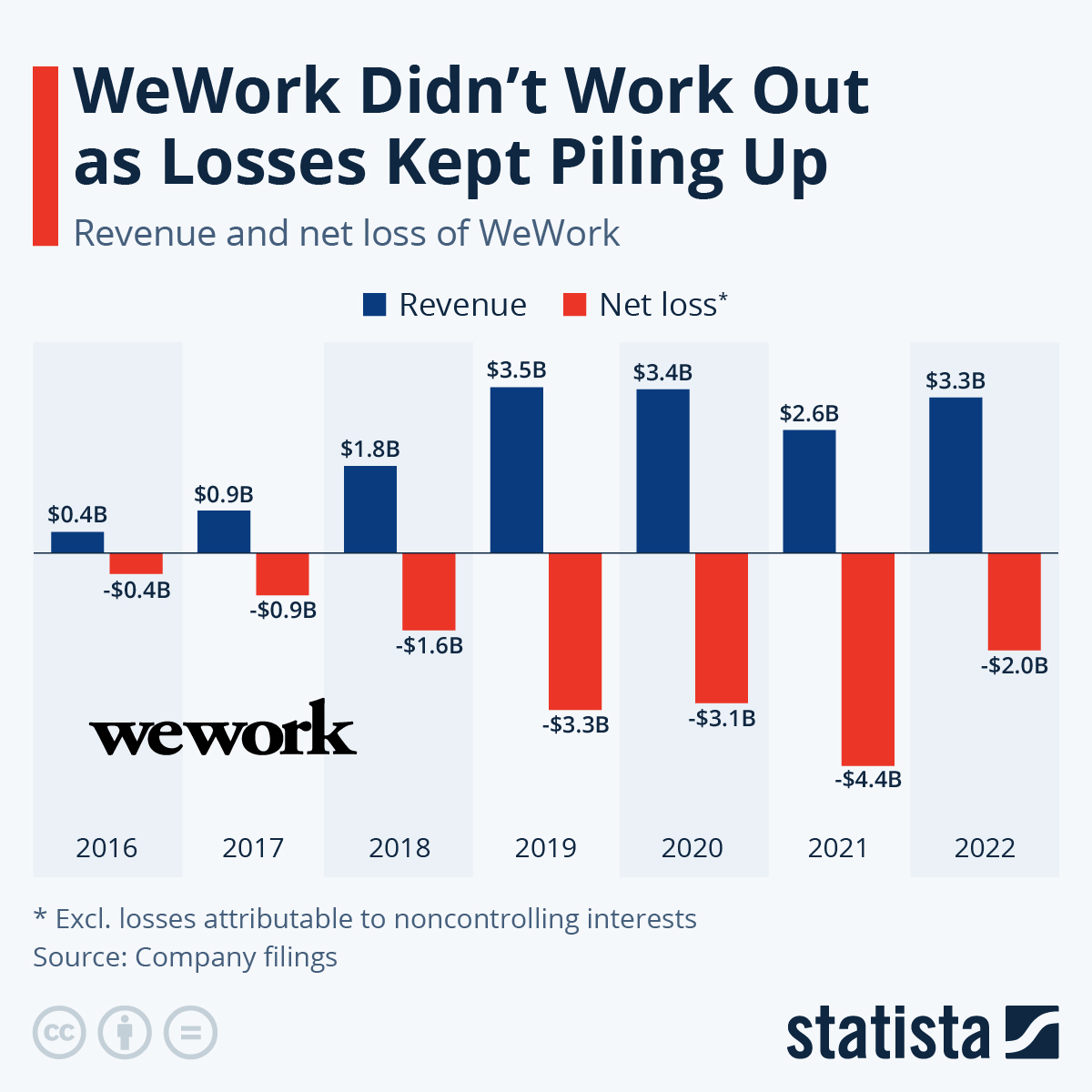

As our chart shows, WeWork’s losses have grown in line with its revenue, as expensive leases continued to weigh on the company's results. Since 2016, WeWork's losses have piled up to more than $15 billion, as did the company's debt. In a filing with the New Jersey bankruptcy court, WeWork listed liabilities of $18.66 billion as of June 30, which are standing opposite assets worth $15.06 billion.

In a statement on Monday, WeWork said that it would "continue servicing its existing members, vendors, partners, and other stakeholders in the ordinary course of business. WeWork expects to have the financial liquidity to execute these proceedings and continue business in the ordinary course."