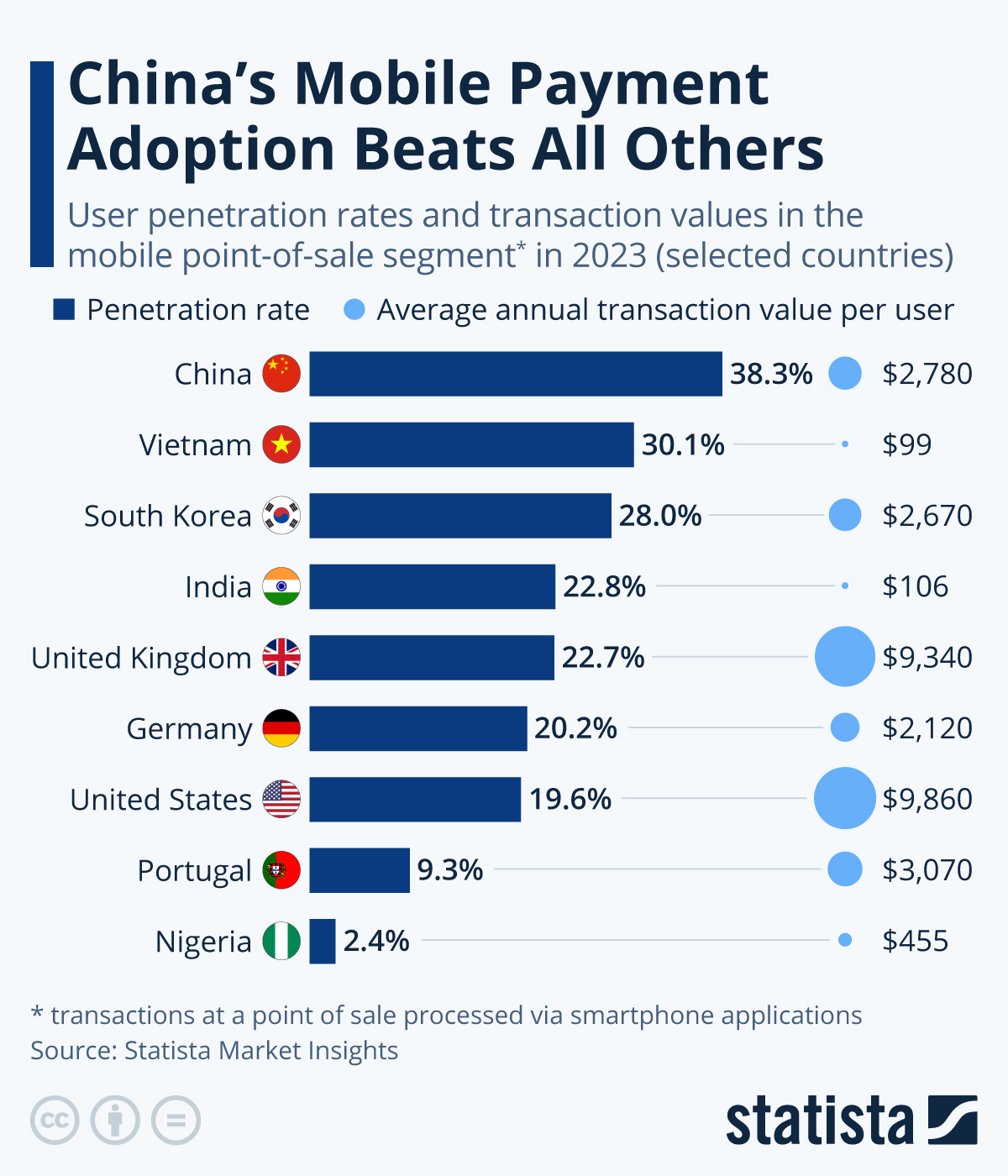

More than half a billion people in China will be paying with phones applications at a point-of-sale this year, according to the Statista Digital Market Outlook. This can be a physical store or restaurant as well as an online shop. The number equals a penetration rate of 38.3 percent, the highest included in the survey of 44 countries.

China’s booming payment apps market is dominated by big players Alipay and WeChat Pay, which have been adopted widely by shopkeepers, restaurateurs and e-commerce platforms. In a country where a lot of small enterprises cater to customers, the use of credit cards had never been widely adopted, creating a leapfrog effect where businesses moved directly from cash to payment apps.

Yet, the overall annual transaction value per customer is higher in the U.S and several European countries, for example the UK, Portugal and Scandinavian nations. The average Chinese consumer is projected to spend almost $2,800 with payment apps in 2023, compared to more than $9,000 in the UK and almost $10,000 in the United States. The UK also takes the lead when it comes to user penetration in Europe, while Portugal lags behind.

Developing countries in Asia like India and Vietnam, typically have payment app penetration levels above the world average, but the average spent per customer is still extremely low, suggesting only very casual usage by a big chunk of consumers. African countries like Nigeria are known for their mobile payments in the non-smartphone segment, but haven't quite caught up when it comes to digital wallets.