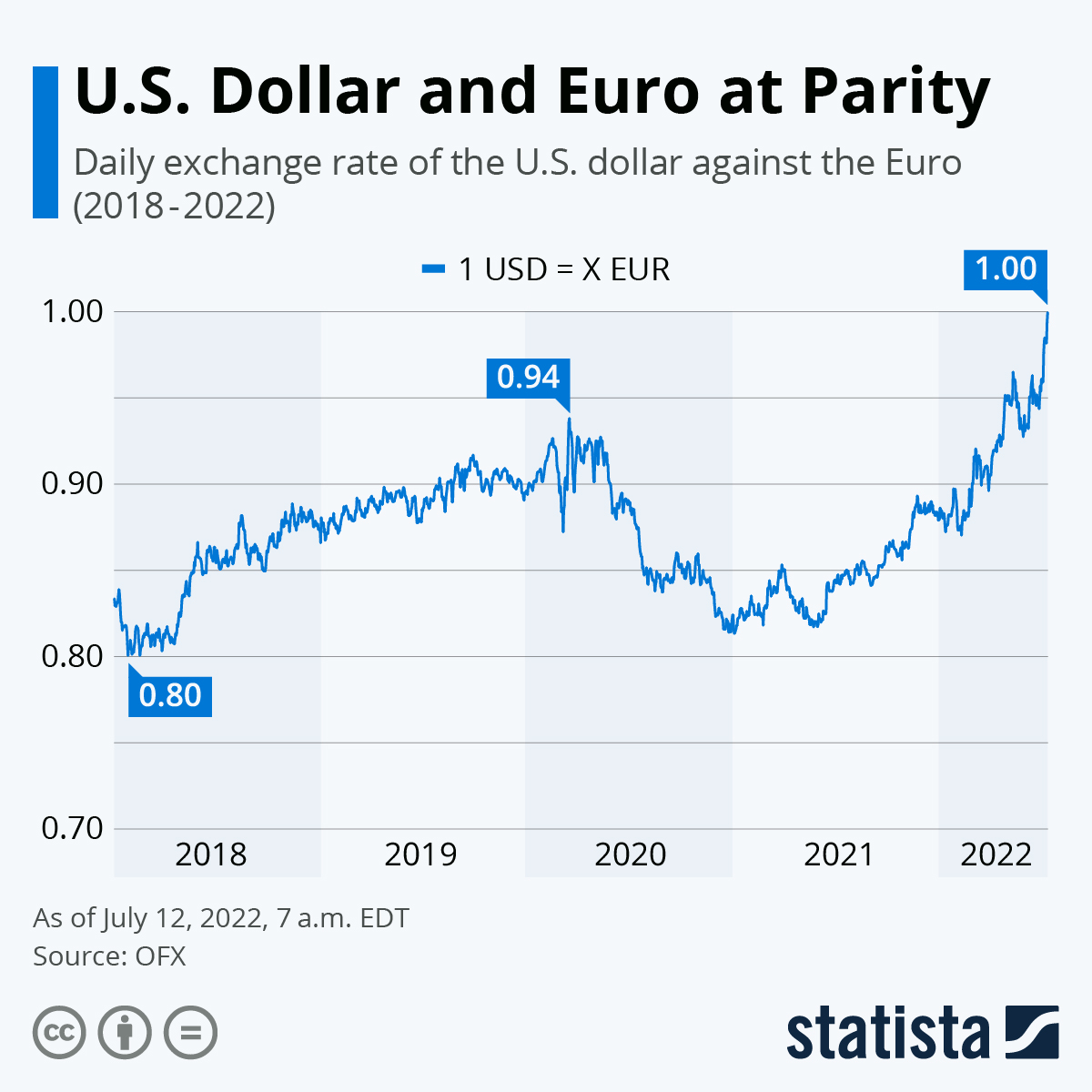

For the past 12 months, the U.S. dollar has been strengthening against the Euro. On this Tuesday, both currencies reached near-parity, with one U.S. dollar priced at 0.9998 Euros by 5 a.m. EDT. By 11 a.m., the exchange rate was down to 0.9945, according to OFX. It is the first time in 20 years that both currencies are valued the same.

The Fed's quite aggressive tightening of interest rates in 2022 did its bit to attract investors to the dollar due to increasing returns on money lent. As more people buy (in) dollars, the demand for the currency goes up, strengthening it in the process. Fears of a gas crisis in Europe should Russia decide to turn off supplies further turned buyers off the Euro, in turn weakening it. The first European Central Bank hike amid the current inflation crisis is still outstanding and expected for later this month.

A strong dollar has advantages (namely cheaper imports) but there have been many critical of the strong dollar, including former U.S. President Donald Trump. Trump said repeatedly that he would support a FED policy weakening the dollar, because it would aid U.S. companies doing business abroad or exporting goods and services. Currently, businesses who have to convert foreign earnings back into dollars are getting out less and are therefore potentially less competitive. China’s Central Bank, for example, has been accused of keeping its currency artificially low to be very competitive in the global export marketplace.