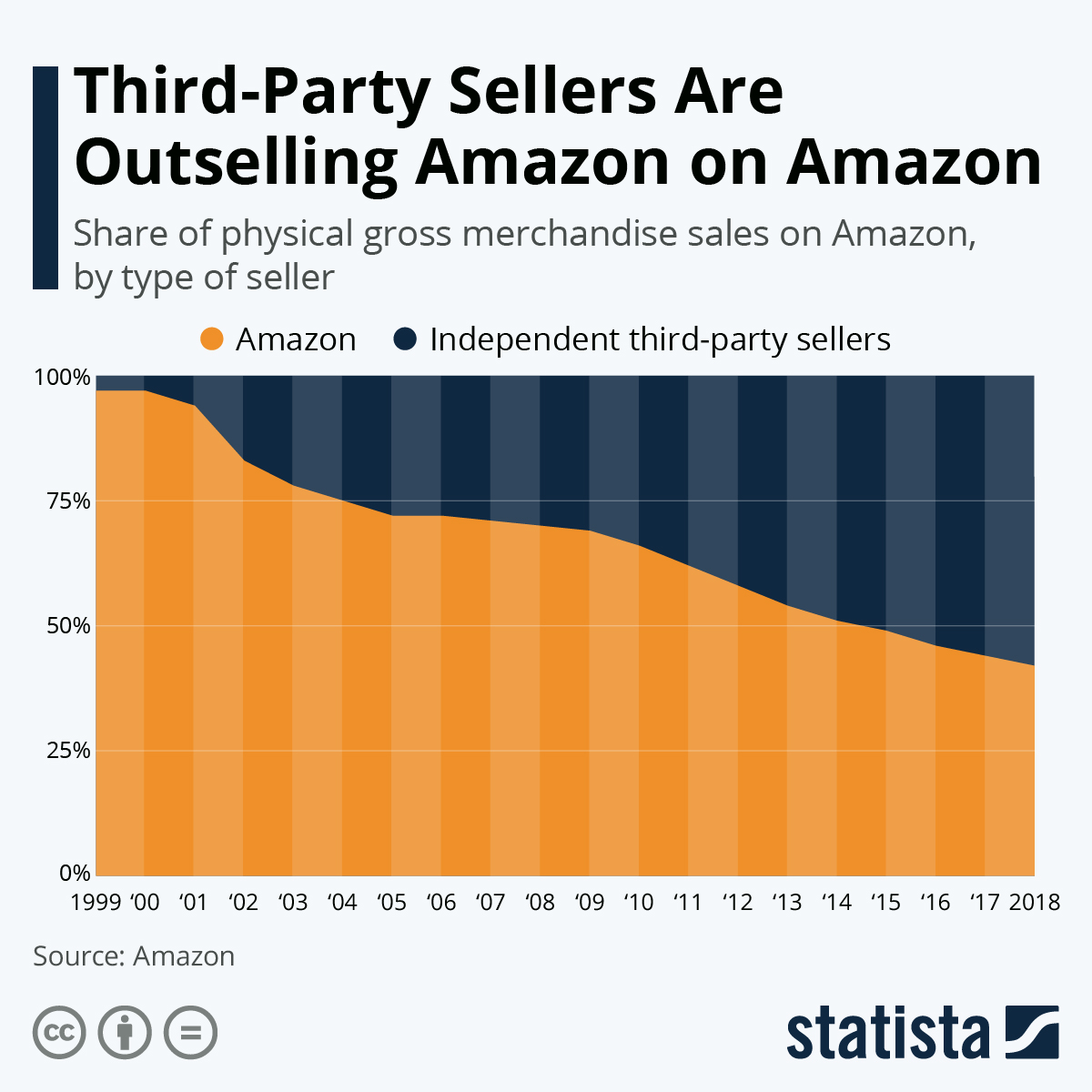

Coincidence or not – just at a time when Amazon started facing increasing antitrust scrutiny over its dominant position in the e-commerce and retail landscape, the company, notoriously shy on disclosing details about its business, decided to share some interesting data with the public. In a bid to paint his company as a partner of small and medium-sized businesses rather than an all-consuming behemoth, Amazon’s founder and CEO Jeff Bezos disclosed last year that third-party sellers accounted for 58 percent of total physical gross merchandise sales on Amazon in 2018, up from just 3 percent in 1999.

“Third-party sellers are kicking our first party butt. Badly.”, Bezos self-deprecatingly wrote in a letter to shareholders, only to add the not-so-subtle humblebrag that third-party sales on Amazon, while beating the company’s first party sales, have also grown much faster than eBay’s gross merchandise volume between 1999 and 2018. According to Bezos, third-party sales on Amazon grew from $0.1 billion in 1999 to $160 billion in 2018, while the company itself sold $117 billion worth of physical merchandise that year.

Ironically, Amazon’s role as a platform for independent third-party sellers is what got the company into trouble in Europe. The European Commission launched an investigation into whether “Amazon's use of sensitive data from independent retailers who sell on its marketplace is in breach of EU competition rules”. In recent years, the EU watchdog has proven not to shy away from going head to head with America’s tech giants, imposing billion-dollar fines on Google and Microsoft. If found guilty of anticompetitive behavior, Amazon could also face a multi-billion-dollar punishment.