Perhaps the most interesting piece of information to come out of PayPal’s relatively uneventful earnings report on Monday was the fact that the company has partnered up with Amazon to make Venmo a payment option for U.S. Amazon customers starting next year. The announcement is a major step in PayPal’s ongoing efforts to turn its popular person-to-person payment service into a broader payment solution. Numerous popular retailers in the U.S. are already accepting Venmo payments and customers can also apply for a Venmo credit card and keep track of their purchases within the Venmo app.

According to PayPal's announcement of the Amazon partnership, 47 percent of users had expressed the desire to pay with Venmo when making online purchases in a behavioral study commissioned by the company. “Over the last year, we have focused on giving our Venmo community more ways to use Venmo in their daily lives,” Darrell Esch, Senior Vice President and GM of Venmo said. Adding Amazon to the list of retailers accepting Venmo payments definitely goes a long way in achieving that goal.

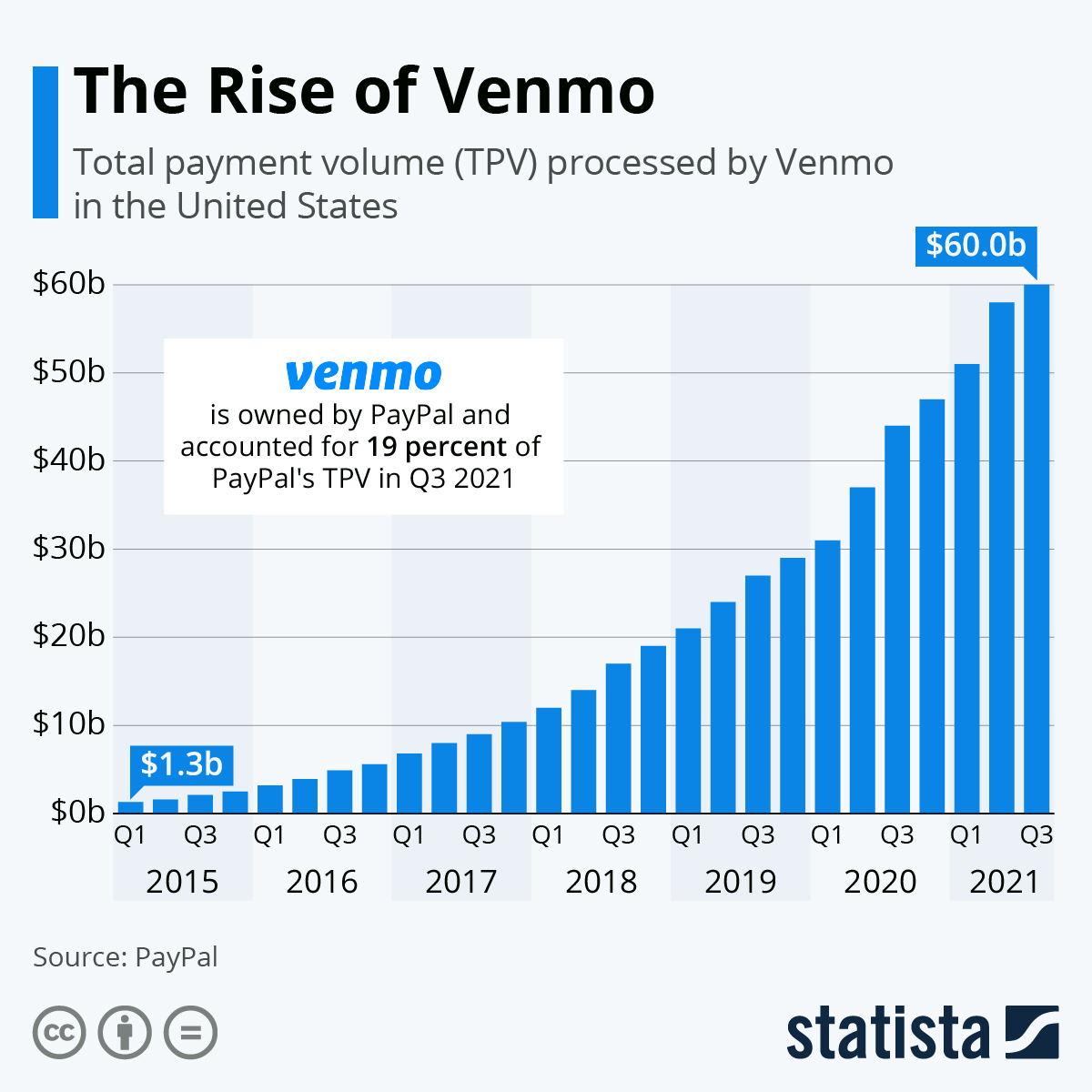

As the following chart shows, Venmo, which is still a U.S.-only service, has seen blockbuster growth over the past few years, as young Americans in particular enjoy the simplicity of splitting bills or sending money to friends by the touch of a finger. In the three months ended September 30, total payment volume processed by Venmo amounted to $60 billion, up from less than $5 billion five years ago.